SX Business Services Employee Spotlight: Lisa Moran, Client Controller

Lisa joined SX in September of 2021 with 24 years’ experience in commercial and residential real estate accounting. During her time at Northeastern University, she worked in public accounting throughout her co-ops. After graduating from NU with a degree in accounting, she worked for several international companies with divisions in the UK and Canada, then made her move into real estate accounting.

Lisa met her husband Bob on a blind date, and have been together for 34 years! They are approaching their 29th wedding anniversary! They share two sons, Jack, 25, a 2018 graduate of Plymouth State University with a degree in sports management/minor in sales and Jeff, 21 a Junior at Michigan State University where he is majoring in Communications. Don’t tell the boys, but their baby girl, Kennedy, is almost 5 years old and is a Chocolate Lab/Australian Shepard mix. She is the love of their life.

Beyond her breadth of work experience, she brings her lively spirit and positive attitude to the office. She loves to travel and credits her grandmother for taking her overseas to Japan, Taiwan, Hong Kong, Greece, and Italy. Their family loves a good road trip too. Their goal is to travel around the U.S. to visit all Major League baseball parks and have been to 29 of the 30, with only Seattle left to see.

Her commitment to her family and her work bleeds over into her community. She is the team manager for the Dedham Clippers Swim team. She runs the concession stand for Dedham Youth Baseball. She is the Treasurer and Board member for the Dedham television station. Additionally, she has served many years as a Town Meeting Member and served as district chair for 8 years. She is now an elected official serving on the Parks and Recreation Commission. Incredibly she served as chairwoman this year – the first woman Commissioner and Chair elected in 15 years!

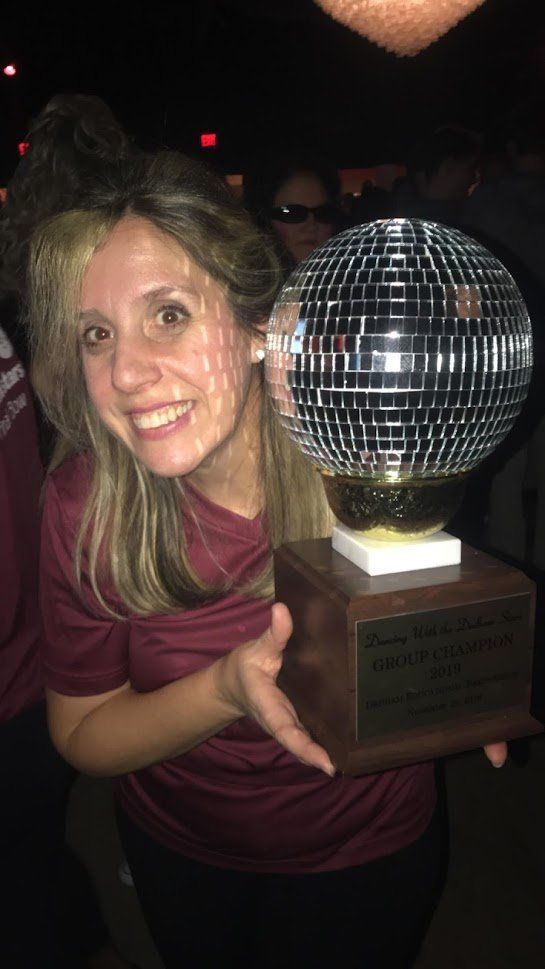

During her downtime (yes, I am surprised she has some too) she is very involved with the Miss America pageant at the state level, as a judge for many local events and volunteering in several capacities. She has been to watch the Miss America pageant three times. Her other passion is dance and she is back to taking weekly dance classes, 50 years after her first lessons. She is admittedly obsessed with Dancing with the Stars and has been to 13 of the live tours. During one of her visits to see the DWTS live tour she was able to secure a video of the cast recommending her for entry to a Dancing with the Stars fundraising competition in her town! She was accepted and after weeks of grueling rehearsals and after a first-place tie, she was ultimately deemed the runner up. A few years later, on the 10th anniversary of the competition, she was able to return as an all-star with her dance team. Their dance performance from Grease earned her the sweet redemption she was looking when they won the whole shabang!