List of the Most Frequently Asked Questions

SX Business Services was established in 2011 to help companies optimize their financial department with outsource accounting services. Our company provides accounting outsourcing to businesses, specializing in property accounting. Continue reading to find a compiled list of the most frequently asked questions that prospective businesses want to know about outsource accounting services and SX Business Services.

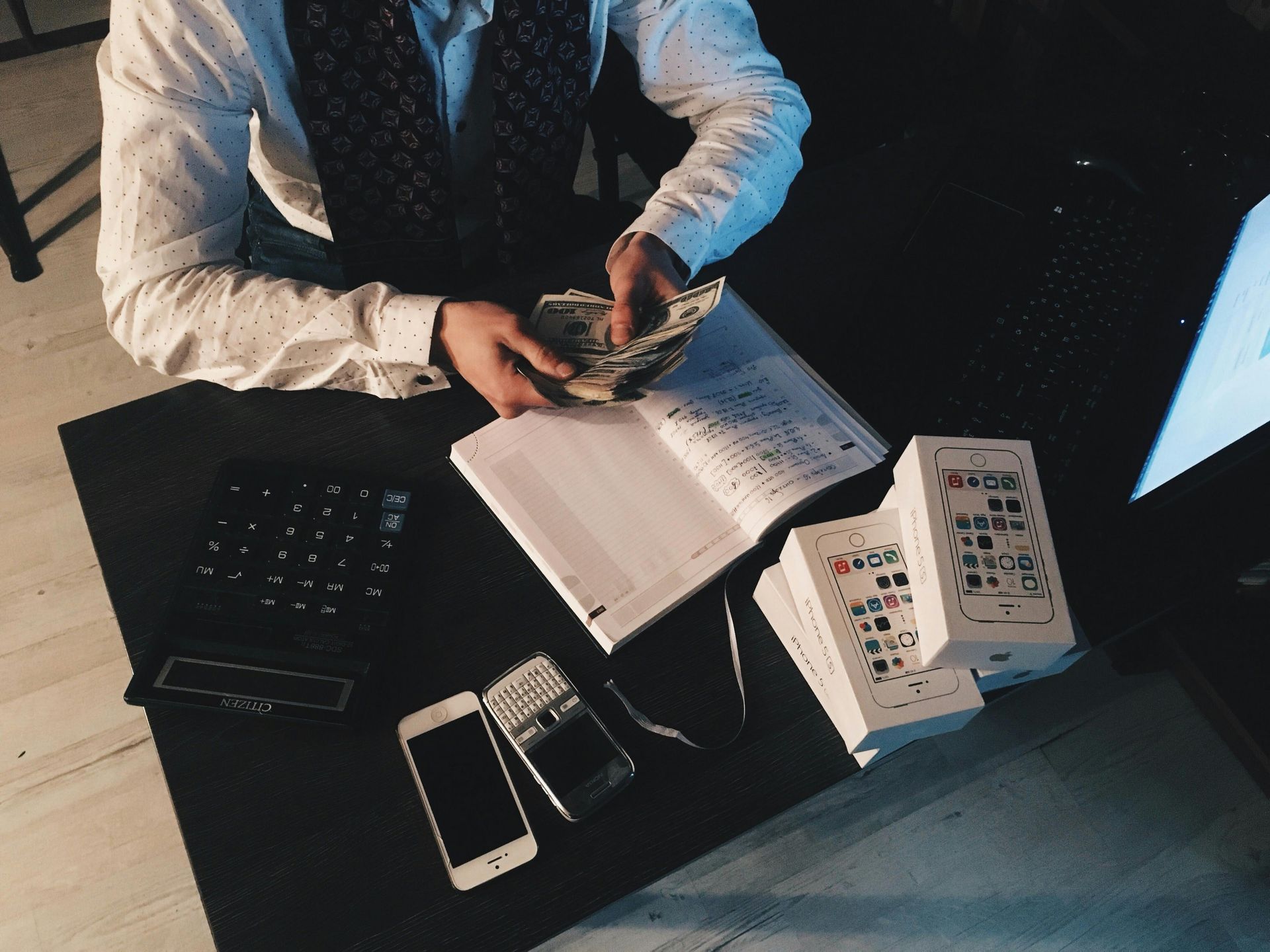

Companies who hire an outsourced accounting firm do not have to deal with the burdens and expense that come with having in-house employees.

1. Why would a company utilize outsourced accounting services?

Outsourcing services have become a mainstream practice in the business world and accounting is not an exception. Many companies use outsource accounting services to handle either all aspects of their financial department needs or they utilize it for part-time help. Either way, companies who hire an outsourced accounting firm do not have to deal with the burdens and expense that come with having in-house employees.

Top reasons why a company would outsource their accounting needs are:

• Cost: Companies save money by outsourcing their accounting by not having to pay for email and software licensing, employee’s benefits, taxes, paid time off, or the time it takes to hire, train and setting up office space. We minimize our client’s internal costs by 30-50%.

• Scalability and customizable approach: You pay for the services and level of accounting help that you need. If your company has a CFO but could use a quality Controller once a week to handle financial reporting, or maybe your business has a Controller, but could use a Staff Accountant or Bookkeeper to help with those tasks.

• Having industry-specific accounting experts and software specialists: It’s important that your outsourced accounting team understands your industry’s specific accounting needs and can get up and running on your accounting software quickly.

• Business owners have more time to work on their business instead of crunching numbers: Spend time that makes you more money, instead of costing money.

2. Why hire SX Business Services?

What differentiates SX Business Services from other outsourced accounting firms is our professionals and staff have well over 50 years of experience in all financial related services and have the ability to expertly handle any or all aspects of accounting functions for your company. We are well versed in just about every accounting software platform, including Nexus, Yardi, MRI, OneSite, Entrata, RealPage, Avid Exchange, Ops Technology and QuickBooks, as well as being a Nexus partner. We provide expert implementation and support to provide you with maximum visibility, accountability and control. Our team is highly engaged and very accessible.

3. Does SX Business specialize in certain industries?

SX Business Services has expertise in property accounting to provide the highest level of accounting and software help. 85% of our clients are in the real estate industry. However, no matter what industry, SX Business Services becomes a highly effective extension of client operations by delivering timely, dependable and cost-effective results. Whether your company is a start-up organization with little to no accounting resources in place or a firm with an already established accounting department, SX Business Services can provide you with a customized plan to meet your company’s needs.

4. What accounting software do you work with?

When working with SX Business Services, your company gets the added benefit of having a team of outsourced accountants who know your industry and your accounting software. We offer the ability to jump on our accounting platforms and licenses, with Yardi and Nexus. Nexus is our online storage, purchase order and invoice approval system. Yardi is our accounting and property management software. If you prefer, to offer greatest flexibility, we can work through your software platform.

5. How much does outsource accounting services cost?

The cost varies on the amount of accounting work needed and the level of services provided. Many companies take advantage of outsourcing their accounting because they have been both underutilizing and overpaying their in-house staff. Outsourcing allows businesses to enhance processes, scale resources, improve their accounting function and focus on business growth. If your needs are part-time accounting or a fully outsourcing your accounting department, we can meet your unique requirements.

For a pricing quote: https://www.sxbusiness.com/book-online

6. Does SX Business work remotely or on-site? Does my company need to be located in Massachusetts?

SX Business Services uses technology to provide accounting services anywhere in the United States. In fact, we have clients all over the U.S. Currently, our largest clients are located outside of Massachusetts.

7. Who provides the accounting services?

We use the team approach to provide accounting services for our clients. Unlike traditional office settings where employees have vacation days or call in sick, we have you covered with the “next one up” that has been cross trained on your entities. Our professionals and staff have well over 50 years of experience in all financial related services and have the ability to expertly handle any or all aspects of accounting functions for your company. The benefit of having multiple finance professionals working on your financials is that at any given time, you have access to answers. If anyone leaves there will still be a point person managing your account for a streamlined approach.

8. Is SX Business Services a CPA firm?

No, SX Business Services does not provide tax returns or perform audit work for clients. We will help with pre-audit work to get organized and prepared. In addition, we can be a resource to help answer questions from your firm’s CPA and provide timely monthly financial statements and year-end accounting help

9. How can I get started?

Please fill out this form and we’ll be in touch to answer any of your questions regarding outsource accounting services or provide a pricing quote: https://www.sxbusiness.com/book-online